TL; DR: Wave is a software provider working to relieve small business owners of the stresses associated with managing finances. The company’s suite of cloud-hosted products covers everything from accounting, invoicing, and payments to payroll and receipts. Created for entrepreneurs by entrepreneurs, Wave’s ultimate goal is to support small businesses through a central source of solutions for all of their financial services needs.

Small business owners know that staying on top of finances is critical to success — but most entrepreneurs didn’t get into the game to focus on accounting, invoicing, and payroll management. For many, such tasks are a source of anxiety; a necessary evil.

Tech entrepreneur Kirk Simpson, Co-Founder and CEO of Wave, knows this for a fact. Before founding Wave, he led two startups to success, becoming acquainted with the pain points of managing business finances along the way.

“I know, firsthand, where many small business owners stand on managing finances: It’s the bane of their existence,” Kirk told us. “It prevents them from spending time on the things they love.”

Kirk Simpson, CEO, gave us the scoop on the inspiration behind Wave.

Knowing there had to be a better way, Kirk joined forces with Co-Founder James Lochrie in 2010 to create Wave, a financial management software suite for small businesses that’s hosted conveniently in the cloud.

“There’s a positive side of successfully managing your business finances — you feel it when you get a great tax refund, when you have better visibility into your company, or when you’re getting paid by your customers faster,” Kirk said. “Our goal with Wave is to highlight those positives and try as hard as we can to eliminate the pain.”

What started as a staff of eight employees working from a small workspace in Toronto quickly blossomed into a growing company of 250-plus employees serving small businesses and freelancers across the globe. Today, Wave’s software suite contains solutions handling accounting, invoicing, payments payroll, and receipts — many of which are free.

Devotion to the Small Business Community

Over the past decade, businesses of all sizes have been undergoing a shift in how they approach technology that’s commonly referred to as digital transformation.

The process typically involves replacing manual processes with digital ones, but it can also mean upgrading older technology (replacing on-premises hosting with cloud servers, for example). The Software-as-a-Service (SaaS) delivery model is another critical piece of digital transformation. SaaS products, such as Wave, allow businesses to access software via cloud hosting, rather than downloading it on desktop PCs.

While the adoption of SaaS products and other modern technologies has been trending upward for years, COVID-19 has accelerated digital adoption at never-before-seen rates. In a March 2020 Gartner survey, 74% of CFOs and finance leaders said they planned to permanently move a portion of their on-site workforce to remote positions post-COVID-19.

Kirk told us he’s observed a similar shift in the small business world.

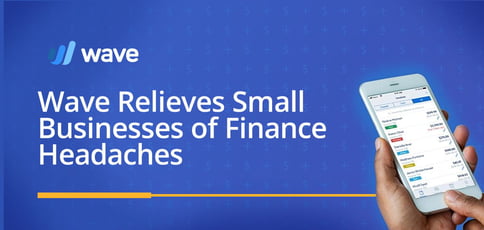

Wave’s customer-centric dashboard, hosted in the cloud, puts all of your tools within quick reach.

“The difference between 2010 and now has been remarkable in terms of the rise of SaaS and the cloud, but the last six months have accelerated the industry by years, if not a decade,” he said. “We’ve seen significant adoption of digital payments: Invoices being paid through digital payments rather than through a check or cash.”

On a grassroots level, Kirk said the ongoing pandemic has also shed light on the value small businesses provide within our communities.

“This experience has made it crystal clear that we don’t want to live in a world where Amazon delivers everything and we’re all eating at chain restaurants,” he said. “We need and value small business owners and their contributions to the fabric of our communities.”

To help small business owners adapt to the change, Wave has released a comprehensive guide called the Return to the Workplace Playbook, and a list of resources for employees affected by COVID-19.

An All-in-One Solution to Manage Your Small Business’ Financial Life

For small business owners, there may be a silver lining in this transformational period we’re in. Kirk told us that small businesses often understand customer sentiment on a deeper level and can pivot more quickly than corporate giants can in the face of change. “For entrepreneurs with a sense of the way the world is moving, this is an amazing time to start a business,” he said. “There’s a huge opportunity to take advantage of the recent changes. We’ve seen that historically, and I think we’ll see that through this period as well.”

The Wave team strives to make the lives of small business owners as stress-free as possible.

Wave can help new business owners ensure a smoother market landing. In addition to web-based products, the company offers personalized coaching on bookkeeping, taxes, and accounting via its Wave Advisors service.

“It’s a mini CFO in your corner,” he said. “We make our tools as easy as possible to use, but for some people, it’s nice to have someone who is very much on their side, looking to help them make better decisions, maximize tax deductions, and all of those kinds of things.”

Between its advisory service and product catalog, Wave is a one-stop shop for addressing the financial needs of small business owners.

“Our goal is to help you manage the financial life of your small business, all in a single place,” Kirk said. “Enterprises can use 20 or 30 different software providers because they’ve got a whole department that’s tasked with stitching together all of those different products and making them useful. But small business owners don’t want to be dealing with APIs, connecting all sorts of different software, and remembering all those different usernames and passwords.”

With Wave, there’s just one username and password to remember and one consistent user experience.

Free Accounting and Invoicing Solutions with No Paywall

One of the biggest perks of the Wave software suite is that the vast majority of it is free. Wave’s accounting platform, for example, includes unlimited bank and credit card connections, income and expense tracking, customizable invoicing, and receipt scanning at no charge.

The same applies to the company’s invoicing offering, which includes tools for creating personalized invoices, turning estimates into invoices, and viewing customer transactions. It also has the capability to manage communications, follow up on overdue accounts, and set up automatic payments, among other features.

“Our invoicing and accounting software is 100% free with no paywall; there’s no sending five invoices and then having to start paying on the sixth one,” Kirk said. “When you get paid by your customers, which happens three times faster when you accept digital payments, we charge industry-standard rates to process those credit card and bank transactions. Faster payments mean better cash flow, and that’s where we make our money.”

Kirk said he believes that all small-business owners should have access to good financial software. After all, it’s key to managing their business well and staying compliant with the IRS.

“Apathy in this space is a big thing,” he said. “A massive component of our development process is based on not only talking to existing customers but also talking to customers who aren’t using us to find out what would get them off the sidelines.”

Eliminate Manual Bookkeeping with Wave Money

In July, Wave announced that it had entered the banking market with the introduction of Wave Money — a first-of-its-kind small business banking and bookkeeping solution.

The idea is to offer small business owners what traditional banks can’t: built-in bookkeeping, instant access to money, and zero fees.

“You are paid faster, get access to money faster, and it’s easier to pay your employees and vendors,” Kirk said. “It’s all in one place, and you never have to reconcile anything. You don’t have to pass anything through manually to tax software. It’s done and ready for tax. ”

When combined with Wave’s entire portfolio of services, small business owners can expect serious savings in terms of both time and money.

“Wave Money brings everything together in a way that can be full service for customers and just make it so much easier for them to run their businesses,” Kirk said.

HostingAdvice.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation from many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across the site (including, for example, the order in which they appear). HostingAdvice.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.