TL; DR: PipeCandy tracks nearly one million ecommerce companies and thousands of direct-to-consumer brands to provide users with the market intelligence they need to make data-driven business decisions. The company makes it possible to track ecommerce companies, assess market potential, and map conversion outcomes via online merchant and audience sensibility graphs. As PipeCandy continues to build out its new Customer & Market Analytics Platform (CAMP), the company is poised to provide vast insight into online audiences, segments, their purchasing behaviors, and their competitor strategies.

Ecommerce sales have increased steadily over the past 20 years, with more than 2.14 billion people across the globe expected to purchase goods and services online by 2021, according to Statista.

In light of recent events, that figure will likely trend upward. After all, the fears of those once hesitant to dive into the world of online shopping have been usurped by a greater threat: the global coronavirus pandemic.

“A few years back, ecommerce was still a relatively new industry,” said Ashwin Ramasamy, Co-Founder and CMO at PipeCandy. “COVID-19 has changed that with everyone staying home as much as possible; it has essentially fast-forwarded the industry by seven or eight years.”

PipeCandy provides ecommerce and direct-to-consumer brand research that helps customers find sweet success.

It follows that professionals and brands from a wide range of industries — logistics, marketing, financial services, retail, tech, and beyond — are scrambling to make sense of the current state of ecommerce through merchant data, consumer data, competitor analysis, predictive analytics, and market research.

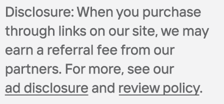

PipeCandy offers all of that and more, making it possible to track ecommerce companies, assess market potential, and map conversion trends via online merchant and audience sensibility graphs.

“If you’re looking to understand the ecommerce landscape, we have the best data, because we are exclusively focused on tracking millions of ecommerce companies and brands,” Ashwin said. “Be it for market intelligence, corporate strategy, or informing go-to-market positions, we have the data you need. If you are beyond that point and want to grow, we have the analytics and customer data to help you do so.”

PipeCandy sits in the sweet spot between traditional market research firms that rely on focus groups and panels and analytics consulting firms that can only analyze data. The company helps brands with GTM strategies based on its own data and analysis of competitors and consumer segments (through its sensibility graph model). PipeCandy then extends that to a DIY model using its new Customer & Market Analytics Platform (CAMP) as customers grow.

Track Ecommerce Merchants and Map Conversion Trends

PipeCandy, founded by Ashwin, Murali Vivekanandan, and Shrikanth Jagannathan, officially opened for business in August 2016.

But the company’s story began in the middle of 2015 when Ashwin, then running the B2B app developer marketplace ContractIQ, needed a way to find relevant leads for thousands of developers. Just a few miles away, his friend Murali, the founder of Ideas2IT, was looking for a way to gather data on prospects.

At the end of 2015, Ashwin and Murali traveled to Bangalore to meet Shrikanth, Ashwin’s colleague from grad school. By February of 2016, the trio conceptualized PipeCandy and officially registered the market intelligence startup.

Today, PipeCandy is much more than a lead-generation service. The company scores prospects for intent signals, boosts returns via account-based marketing campaigns, tracks ecommerce and direct-to-consumer (D2C) brands around the globe, and provides countless insights on each of them.

The company provides in-depth predictive analytics, market research, and lead generation.

“You can think of us as similar to ZoomInfo, but specifically focused on discovering ecommerce companies and D2C brands,” Ashwin said. “We started PipeCandy because we saw an opportunity to really map out the industry and help sales reps better pitch their stories to these companies.”

PipeCandy casts a broad net when it comes to collecting data on ecommerce businesses. The company’s Insights Platform was built from the ground up to deliver information on revenue, market positioning, customer experience strategies, shipping policies, distribution strategies, price positioning, and assortment strategies, among several other metrics and benchmarks.

“Our interest is tracking everything you need to know about an ecommerce company, covering all the nuances,” Ashwin said. “Do they offer curbside pickup, do they offer subscriptions? Are they a multi-brand ecommerce company? These are just a few of the 70-plus attributes that we track.”

Customers looking for answers relevant to specific ecommerce categories or information on competitors can receive custom research and reports tailored to their unique business needs.

Online Brand Insight and Audience Sensibility Graphs

In March, PipeCandy announced the launch of its Brand Insight Graph API, a tool that will help ad networks, financial services firms, D2C brands, consumer packaged goods (CPG) companies, and retailers capture detailed data on ecommerce and D2C segments.

“This graph tells you about the ecommerce company — what they are selling, where they are selling it, how much they are selling, who they are working with for payments and fulfillments, et cetera,” Ashwin said.

In addition to the Brand Insights Graph API, PipeCandy is also launching Consumer Perception and Sensibility Modeling datasets. This resource will identify topics that matter to consumers, segments targeted by competitors, and product ideas the user might be missing out on — ultimately adding a new dimension to customer data.

PipeCandy allows users to access new sales and marketing opportunities.

“If you’re buying, for example, KIND Bars, it’s likely that you care about consuming natural ingredients and living a healthy lifestyle in general,” Ashwin said. “Essentially, when you make a purchase, you’re projecting your values through the brand you’re buying. Your brand choices provide a shortcut to your values.”

That’s where PipeCandy’s new Customer Data Platform (CDP) comes in, helping users understand as much about their audiences as possible.

“CDP helps customers identify lookalike audiences,” Ashwin said. “If you’re selling yoga pants, you might want to sell them to the same audience buying KIND Bars — because they also care about health. The CDP is helping you do things like that. We don’t just provide data about brands; we provide data for brands.”

Continuing to Develop a Cutting-Edge Customer Data Platform

Moving forward, PipeCandy is continuing to focus on CAMP, which the company predicts will create a paradigm shift in the ad tech space, especially in terms of the ability to discover segments and target audiences without relying on cookies.

“If you are an ecommerce company or a brand, you should be able to market to a segment of one,” Ashwin said. “You need to know the propensity of a customer segment’s interest in your product and understand why they buy your product or their substitutes. You need to know the channels they already hang out in and be able to talk their language. All of this today is left to the expertise of the marketer. But there is enough data to arrive at these insights. That’s what CAMP enables but at the fraction of the cost of a consulting firm or a complex mix of third-party data and analytics solution costing over a quarter million — which a D2C brand cannot afford!”

“Within two years due to phasing out of third-party cookies, you will not be able to advertise to your audiences by tracking their actions on the web,” Ashwin said. “That’s why we are building out a market analytics and audience segment sensibility solution that helps you understand who your customers are, identify lookalike audiences through a private marketplace, and improve your acquisition strategy.”

HostingAdvice.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation from many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across the site (including, for example, the order in which they appear). HostingAdvice.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.