TL; DR: Compliance with securities regulations, system scalability, and data security is crucial when purchasing digital assets like STOs or NFTs. Vertalo aims to bridge the gap between TradFi and Defi by providing a secure platform that prioritizes pre and post-issuance investor data management. Vertalo addresses common digital asset management challenges, such as regulatory compliance, security concerns, and authentication issues.

Whether it’s security token offerings (STOs) or non-fungible tokens (NFTs), you have to adhere to specific compliance regulations when you buy a digital asset. Unfortunately, it’s not as easy as hitting the checkout button; you must also consider relevant regulatory bodies and data protection procedures.

For example, say you bought an NFT. Not only do you have to make sure it’s authentic, but you may also have to understand the rights and responsibilities you’ve been given, evaluate the value and validity of NFT, and perhaps determine the market value for long-term investment potential.

In other words, buying your Bored Ape Yacht Club NFT or slice of real estate isn’t always rainbows and butterflies.

Vertalo aims to bridge the gap between buyers and the legal hurdles it takes to legally and securely establish ownership. Dave Hendricks, CEO of Vertalo, describes the company’s mission to connect and enable the digital asset ecosystem this way:

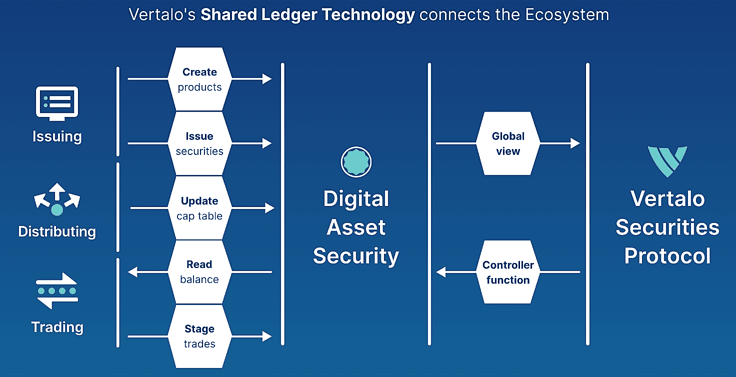

“It’s a digital asset data management system, API-first enterprise software, and an SEC-registered transfer agent,” Dave explains. “And our founding story comes down to three guys who’ve known each other too long but encountered the same problems, so we created a new solution to those problems.”

Bridging the Gap with Vertalo

Vertalo was founded in 2017 after Dave and his co-founders, William Baxter and Gautam Gujral, noticed due diligence issues within the crypto space.

Dave refers to the apparent disconnect as a lack of efficient communication between issuers (the entities offering digital assets) and investors (buyers).

This gap encompasses various challenges, including:

- Regulatory compliance: Investors may not know they have to be familiar with Anti-money Laundering (AML), Know Your Customer (KYC), and securities laws

- Security concerns: Investors need to use secure platforms to safeguard their assets from hacking, fraud, and theft

- Tax compliance: Taxation laws can be complex and vary by jurisdiction, so investors need to accurately report their transactions to avoid penalties

- Authentication and verification: NFTs need to be authenticated to prevent purchasing counterfeit or fraudulent items

- Lack of investor protection: Unlike traditional financial markets, digital asset markets may lack certain buyer protections

And without following the proper process, investors could face penalties and loss of ownership.

The Vertalo founders experienced this firsthand when they saw the same issues — not seeing enough support for post-issuance data management — with their digital asset compliance.

“Anyone else who wants to buy a digital asset is going to go through the same painful process we did,” Dave notes. “And we thought if we could solve that, then we’re going to have an exciting business.”

Navigating Compliance Challenges

The pain point Vertalo aims to solve is particularly notable among those in the financial industry. Although there is a decline in proprietary trading, some financial institutions are still interested in the underlying technologies.

Dave also notes the market is moving quickly, with institutions creating solutions to monitor the market 24/7 and businesses making their crypto-related solutions. So many organizations are curious about using crypto and developing new business opportunities.

“People and institutions were learning beyond just the tokens built with the technology, but underneath it,” says Dave. “They’re understanding what’s underneath, which is interesting and useful to modernize what we do.”

Dave says there are two areas to consider: crypto and distributed ledger technology.

“Crypto is a token-type thing, but distributed ledger technology is underneath the tokens,” he explains. “It is a technology that institutions can use to improve record keeping related to assets.”

For example, Dave highlights the potential for companies to create highly secure systems with identity validation and transfer restrictions to protect digital assets, which can help with data center infrastructure, share computing resources, and turn assets into products for businesses.

“Security is critical in finance. Broker-dealers want to protect their investors’ lists from leaks or loss of control; investors who own things don’t want people to come in and steal them,” says Dave. “So these are in the connections you make to outside systems; those also need to be encrypted, and they need to be protected.”

Securing and Tokenizing Digital Assets

Vertalo’s approach to securing digital assets encompasses several key elements:

- API-first approach: APIs allow seamless internal and third-party software integration across the digital asset ecosystem.

- Digital Transfer Agent (TA): With traditional and tokenized transfer agency services, Vertalo is the first platform that securely runs on an institution’s cloud architecture to bridge the gap between legacy systems and new technologies.

- Tokenization and ownership records: Easily tokenize securities and private assets with encrypted ownership records.

- Digital asset management: Easily own and list digital assets by removing the need for complicated blockchain wallets and offering secondary liquidity options through various trading systems and exchanges.

As for what’s next, Dave says he’s excited about what Vertalo can offer for non-financial use cases.

“There’s a mean time between failure for equipment, whether it’s for a datacenter or personal use,” Dave says. “These items have a life cycle; eventually, they are either shelved or decommissioned.”

So Vertalo plans to release a circular economy model.

This model aims to transform assets like computing hardware into tradable securities through recycling and reusing components. Vertalo can track and tokenize components and turn them into valuable assets that can be traded on its platform.

In the meantime, Dave encourages anyone interested in real-world assets to check out Vertalo’s blog and newsletter, “Chain-Enabled.”

“If you want to get into if you are curious, and you want to get deep into the use of digital ledger, technology, and asset management, in finance, or other use cases, or read research reports, Chain-Enabled is the place to go,” he says.

Dave is also optimistic about the future of tokenization: “Over the next five to ten years, virtually everything currently tracked on spreadsheets or brokerage accounts will likely be tokenized in some form or another.”

If you plan to trade, request a demo from Vertalo first.