TL; DR: Sumsub is a know your customer (KYC) and anti-money laundering (AML) solutions company that understands the compliance challenges organizations face. Technological, societal, and regulatory change is steadily increasing the need for robust KYC solutions. Sumsub helps businesses develop more positive onboarding and verification experiences for their customers. The company also shares its in-house legal team’s knowledge with clients to help them transition to new jurisdictions, start new projects, and navigate the evolving compliance landscape.

There’s only one surefire way to know someone’s true identity online — Know Your Customer (KYC) solutions that can digitally verify identity.

KYC tools are helpful for onboarding employees, verifying bank accounts, and accepting merchant payments, among other similar use cases. Many online consumers use KYC workflows because retailers and financial institutions depend on them to fight fraud.

Some users may find those KYC and anti-money laundering (AML) technologies annoying or confusing. Sumsub is a KYC and AML solutions provider that believes understanding user journeys can make digital authentication efforts more effective for organizations and more convenient for those who use them.

Sumsub’s founders have a background in digital authentication, and they know the compliance and legal challenges organizations face online. The founders’ software expertise, and interest in cryptocurrency, led them to develop more intuitive online verification tools.

The founders saw that the rise of cryptocurrency meant higher demand for digital document verification systems, so Sumsub shifted its focus to B2B software. Sumsub’s solutions help clients distinguish the company from the competition and stay ahead in the ever-changing compliance realm.

“I think peace of mind is what we give to our customers,” said Olya Laktyushina, Head of Communications at Sumsub.

Robust compliance simplifies anti-fraud efforts at organizations so Sumsub clients can focus more on their customers and business goals, Olya said. Beyond providing online security, Sumsub KYC tools don’t detract from the user experience, and having the tools to verify user journeys can empower organizations.

How Sumsub Keeps Up with KYC’s Growth

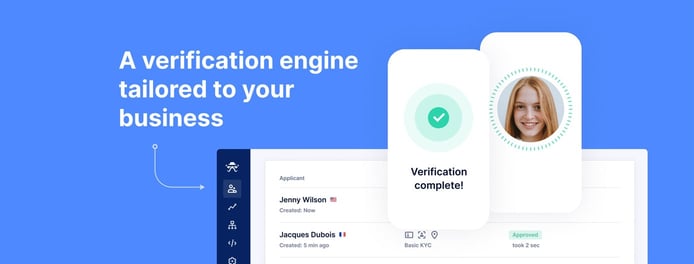

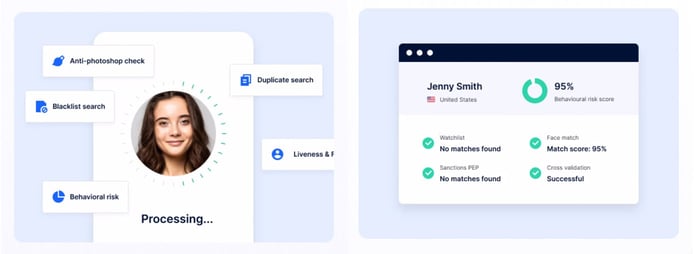

The popularity of KYC tools means Sumsub must keep up with industry changes and regulations designed to protect consumers, companies, and institutions from fraud. Verification increasingly means innovating more complex and sophisticated technologies that stay a step ahead of cybercriminals.

That’s why companies that seek KYC solutions need to understand that compliance is constantly evolving, and they must always be prepared to manage emerging threats.

“More and more companies need this. And as regulations are getting more complex, especially in the crypto world, now it’s a must,” said Olga Burnaeva, Product Marketing Manager at Sumsub.

Outside forces such as the COVID-19 pandemic in 2020 and the growth in popularity of crypto assets have also expanded public interest in online fraud prevention strategies. Technological development, including the widespread availability of digitally altered deep fake videos, makes it more challenging to evaluate people and separate legitimate users from malicious actors.

Sumsub offers video authentication tools for onboarding that combine simplicity and speed with technology that can quickly determine authenticity.

Olga said she believes that these industry changes make Sumsub’s mission to stay informed on compliance issues and ahead of industry trends more important than ever.

Beyond QA: Sumsub Takes On User Journeys

“We love to describe ourselves as an all-in-one compliance tool,” said Olga. But, unlike some of its competitors, Sumsub is about much more than just quality assurance, she said.

Aside from regulatory complexity, Sumsub customers often face an additional nuance: the human element. Many end users understand the benefits but remain frustrated by anti-fraud and verification software experiences.

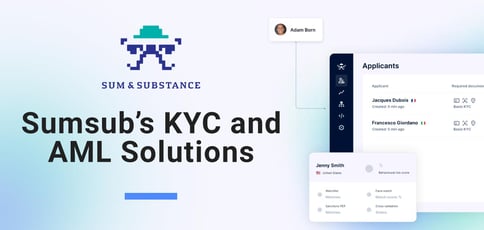

Companies that analyze their entire customer journeys appreciate Sumsub’s approach to user experience. It offers a user journey builder that helps companies track each step of the user journey — down to individual segments.

With advanced case management tools, Sumsub can help clients see why specific users are banned or rejected during the KYC process and view documents submitted during onboarding. They can also identify steps in the process that frequently result in more rejections.

This workflow enables businesses to catch suspicious accounts earlier and assist users who were incorrectly rejected.

Clients can also use Sumsub tools to make strategic changes to their onboarding and anti-fraud processes. That’s because they now have the supporting data to make more effective decisions, according to Olga. They can also quickly fix declining engagement within the onboarding process with the correct information.

“They can basically manage the entire journey in the background and on the dashboard. And we offer advanced analytics and statistics which helps them see where conversions drop,” Olga said.

As companies increasingly operate across borders, gaining an in-depth understanding of the user journey — and how it relates to compliance — becomes essential for organizations. No two countries have the same regulatory frameworks, so it makes sense to approach each jurisdiction with customization in mind. Many organizations lack the in-house expertise to account for those transitions.

Sumsub makes its legal team of specialists available to help clients build effective compliance systems that follow regulations. For example, Sumsub experts can help a company entering a new region make sense of the regulations that apply in that area. The team can also determine how compliant their existing KYC practices may already be. Sumsub believes that service differentiates it from competitors.

“It’s a problem for customers when they launch a new product in another jurisdiction. They need somebody to help them understand the requirements,” Olya said.

Sumsub Shares Thought Leadership and Legal Expertise

Sumsub was founded to help organizations navigate the complexities of KYC, onboarding, and compliance issues. Its blog helps further that mission with informational content on identity fraud, fintech, legal compliance, and data protection issues.

Blog articles cater to readers interested in security and regulatory compliance and provide them with tips on how organizations can strengthen their internal compliance efforts.

Sumsub also investigates common security and technology topics on its popular YouTube channel to make its content accessible and interesting to a broader audience. For example, one recent video titled, “What I Found On A Stranger’s Laptop From eBay,” shows the pitfalls of being lax with personal information.

As Sumsub grows, it is well-positioned to become a thought leader in internet security. The company believes that emphasizing sharing its expertise will help clients while advancing the global fight against online fraud.

Sumsub encourages companies to adopt compliance technology without harming user journeys whenever possible. Organizations can improve customer engagement and reduce friction by finding the sweet spot between gathering the correct information for authentication processes and creating streamlined experiences.

“I think with this technology we work on, we’ll continue to broaden the network because it makes user journeys easier and helps companies increase conversions. And, of course, it helps them earn more revenue at the end of the day,” Olya said.

HostingAdvice.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation from many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across the site (including, for example, the order in which they appear). HostingAdvice.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.