TL; DR: Passbase is a developer-friendly digital identity system designed to put privacy and data security first. The flexible suite of tools includes solutions for facial recognition, identity verification, liveness detection, KYC screening, and AML compliance. Best of all, Passbase’s zero-knowledge architecture ensures that companies can securely verify user identities from more than 190 countries without storing their data.

Regulations, though often necessary, have the potential to bring innovation to a screeching halt. This is particularly true in the healthcare and financial services sectors, where compliance with identity and data protection laws is of utmost importance.

But compliance doesn’t have to come at the expense of operational agility or investments in innovation. Today’s developers can turn to affordable digital identity systems like Passbase for access to a flexible suite of tools designed to manage compliance risk and build trust with customers.

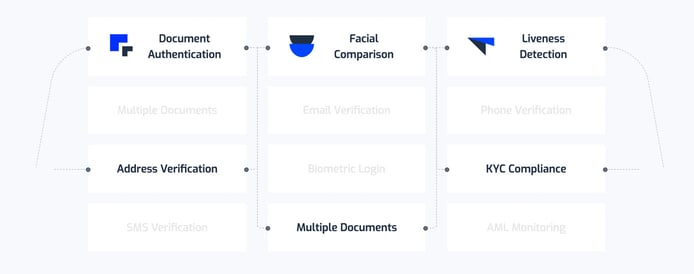

With Passbase, it’s easy to integrate features like facial recognition, identity verification, liveness detection, age verification, KYC screening, and even anti-money laundering (AML) compliance into sites, apps, and checkout systems.

Founder Mathias Klenk gave us a look at Passbase’s secure and innovative digital identity tools.

“Our goal is to take on security and privacy concerns so young startups don’t have to,” said Mathias Klenk, Founder and CEO of Passbase. “Instead, they can focus on attracting users and growing their businesses.”

Passbase’s goal is to provide a digital identity system that puts privacy and data security first — thereby facilitating a more secure digital world. Using APIs and mobile SDKs, developers can offer a seamless identity-verification experience for users in over 190 countries. And, thanks to Passbase’s zero-knowledge architecture, they can do so without storing user data.

A secure user authentication process is especially crucial as COVID-19 forces more workers out of physical offices and onto digital platforms. To that end, Passbase’s identity verification solution aims to enable companies to expand remote employment by verifying users at scale.

A Developer-Friendly Identity Verification Solution

After graduating from Stanford in 2017, Mathias set out to find a place to live in San Francisco. There, he met Co-Founder Dave McGibbon on Craigslist, who had a spare room up for grabs.

“We had lived there for about a year when we decided it was time to start something new,” Mathias said. “At the time, I was working in cybersecurity for a startup in San Francisco, and Dave had been working at Google for about three and a half years. We got together with Felix Gerlach, an old friend of mine from Germany, and the three of us decided to do something in blockchain and crypto.”

The trio built an app for trading and purchasing cryptocurrency, but it wasn’t long until they ran into challenges regarding user identification and regulation compliance. After searching a market full of outdated, enterprise-geared solutions, the team realized there was no developer-friendly identity verification software to be found.

“That was the turning point — the crypto project was fun, but we knew we could build something very meaningful in the user identification space, where there was a massive opportunity.”

Passbase was founded in 2018. Pre-seeding funding of $500,000 that year and a $3.6 million seed round in 2019 spurred dramatic growth. By March 2020, when the COVID-19 outbreak was declared as a pandemic and remote work became more prevalent, the company was prepared to scale to an even greater extent.

“It’s been a tailwind for us ever since the pandemic broke out — we grew by sixfold in terms of our business, and there’s currently no end in sight,” Mathias said. “We just grow and hire, grow and hire.”

Satisfy Strict Compliance Requirements and Battle Fraud

Today, Passbase customers hail from a range of sectors, including healthcare, fintech, ecommerce, and the gig economy. Mathias told us clients seek out solutions that satisfy three needs: compliance, trust building, and fraud protection.

“For example, telemedicine providers, fintech companies, and neobanks use us because they have the challenge of complying with ever-changing laws and regulations,” he said.

Passbase’s comprehensive risk solutions provide the resources these customers need to make smart decisions, including real-time updates, access to global watchlists, and information on international sanctions, financial crimes, and wanted lists across 10,000 registers and 190 countries.

Users can easily add or remove steps depending on identity verification requirements.

“Passbase has significantly reduced the time and cost of our manual review process as we grow our user base and prepare to scale,” said Matthew Hamilton, COO of the fintech company Linus, in a testimonial on the Passbase site.

The platform also helps establish trust between people who may not know each other but are connected through an application.

“Think Uber or Airbnb — these are market place models where you may need to get into someone’s car or sleep at someone’s house,” Mathias said. “For trust and safety reasons, we can verify identity documents and anti-money-laundering checks.”

The third and final bucket of Passbase customers consists of those seeking fraud-prevention solutions. Mathias said that the platform acts as a vitamin in these use cases, whereas the company’s compliance and trust-building features, similar to painkillers, solve problems that are already in existence.

“In terms of fraud-prevention, we see a lot of ecommerce companies dealing with age-restricted products,” he said. “Of course, in some cases, fraud, trust, and compliance are overlapping.”

Agile Development Based on Customer Feedback

Ongoing development is vital to the Passbase team, especially when it comes to keeping up with regulations. Mathias credits employee Rose Wanjugu, Strategic Partnerships Lead, for her work in that area.

“Rose previously handled global strategic partnerships at Trulioo, a global identity verification service based in Canada,” he said. “She keeps us on track with regulatory developments — the best advice I can give to other founders is to hire exceptional people like her.”

In terms of new features, the Passbase team derives inspiration from its developer support Slack channels, which clients use to communicate feedback. They can also voice their priorities by voting for their preferred features via links the company sends out periodically.

“It’s a great way to determine the most popular features and prioritize what we build next,” Mathias said. “Of course, our job is to listen to our clients, and then figure out if the feature is right for the platform.”

Passbases’s product team aids in that respect, formulating an overall vision and developmental roadmap. Along the way, progress follows the agile methodology, employing two-week sprints for maximum efficiency.

Up Next: Online Data Ownership Initiatives

In terms of what’s coming down the development pipeline, Mathias said to look forward to an expanded value proposition inclusive of data ownership benefits.

“Right now we help clients from a B2B perspective by allowing them to verify their users,” he said. “But one project I’m personally very passionate about involves the concept that identity data actually belongs to the person being verified.”

Mathias told us he firmly believes that individuals who share their data with a business should be able to trace where that data lies online.

“We are working to launch an online portal where the users who were run through our system can look back and say, ‘Oh, I handed my passport to these companies, and these companies know X, Y, and Z about me,’” he said.

The next development would enable them to revoke access to their data under privacy acts, such as the GDPR or CCPA.

“This is more visionary, happening in the next few years,” Mathias said. “But as an entrepreneur, you have to sail your company toward a North Star.”

HostingAdvice.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation from many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across the site (including, for example, the order in which they appear). HostingAdvice.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the content’s accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our site’s advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our site’s About page.